Letter of Undertaking (LUT) in GST Online

APPLY ONLINE FOR Filing of GST LUT for Exporters

A Letter of Undertaking (LUT) in GST is a declaration filed by exporters who wish to supply goods or services without paying Integrated Goods and Services Tax (IGST) at the time of export. An LUT is an alternative to the payment of IGST and is issued by the exporter to the Commissioner of Central Tax, stating that the exporter agrees to comply with all the rules and regulations governing exports under GST.

Easy Process and Documentation

Required Paperwork

- GSTIN

- IEC (Import Export Code)

- Bank guarantee

- Board resolution

- Declaration

- Letter of Undertaking

Process, Service Charges, Time duration

- When you send us your paperwork, our experienced staff will review your paperwork with local government officials to determine the service’s cost, feasibility, and completion date. After a quote has been given, it remains fixed. Location affects project duration and cost. Send us your documents and specific requirements to get a price and turnaround estimate.

- On an average Procurement takes four to six weeks.

2000+ locations Served

Happy Clients 50000+

Averge Google Rating 4.9

India's Most Trusted Legal Documentation Portal

WHY CHOOSE US

- Lowest Price Guarantee

- No Office Visit, No Hidden Cost

- Serviced 50000+ Customers

IN GST, WHAT IS A LETTER OF UNDERTAKING (LUT)?

WHO IS REQUIRED TO FILE A LETTER OF UNDERTAKING (LUT) IN GST (FORM GST RFD-11)?

Every GST-registered business that exports goods or services is required to file a GST LUT report. The exporters who have been prosecuted for any offence and the tax evasions over Rs 250 lakhs under the CGST Act or the Integrated Goods and Service Act, 2017 or any other existing legislation are not eligible to submit the GST LUT. They would be required to provide an Export bond in certain circumstances.

In this case, the government’s goal was to broaden the base of exports in order to justify the provision of export reliefs. You may get assistance from the GST specialists at IndiaFilings with the submission of your GST LUT or export bond.

According to the CGST Rules,2017, every registered person has the ability to provide an Export bond or LUT under GST RFD 11 without having to pay the integrated tax. They are eligible to submit a request for LUT if the following apply to them:

- They plan to sell items or services in India, other countries, or Special Economic Zones.

- Are listed under GST.

- They want to sell things but don’t want to pay the combined tax.

DOCUMENTS REQUIRED FOR LUT IN GST FILING

The following papers are necessary for submitting a Letter of Undertaking (LUT) under GST.

- LUT cover letter: request for acceptance, signed by someone with the right to do so.

- Copy of application for GST.

- The entity’s PAN card.

- KYC of the person who is authorised to sign.

- GST form RFD11.

- A copy of the IEC code.

- Cheque Cancelled.

- Letter of authorization.

HOW TO FILE (LUT) IN GST?

Follow the easy 3-step process to file Letter of Undertaking (LUT) online.

- Use GST filing/monthly LegalDocsAdvisor offers a LUT file package.

- Our team will get in touch with you every month to discuss details.

- LegalDocs’s expert team will file the LUT and share the recognition.

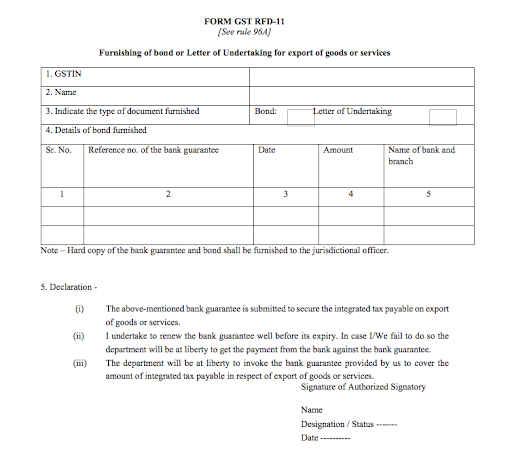

RFD 11 FORMAT FORM

The Form RFD-11 is filed in the following format:

Name on file:

Address for Business:

GSTIN (GST identification number):

Date of delivery:

Signature, date, and location:

Witness information (name, residence, and occupation):

Please see the form attached:

LETTER OF UNDERTAKING (LUT) IN GST FORMAT

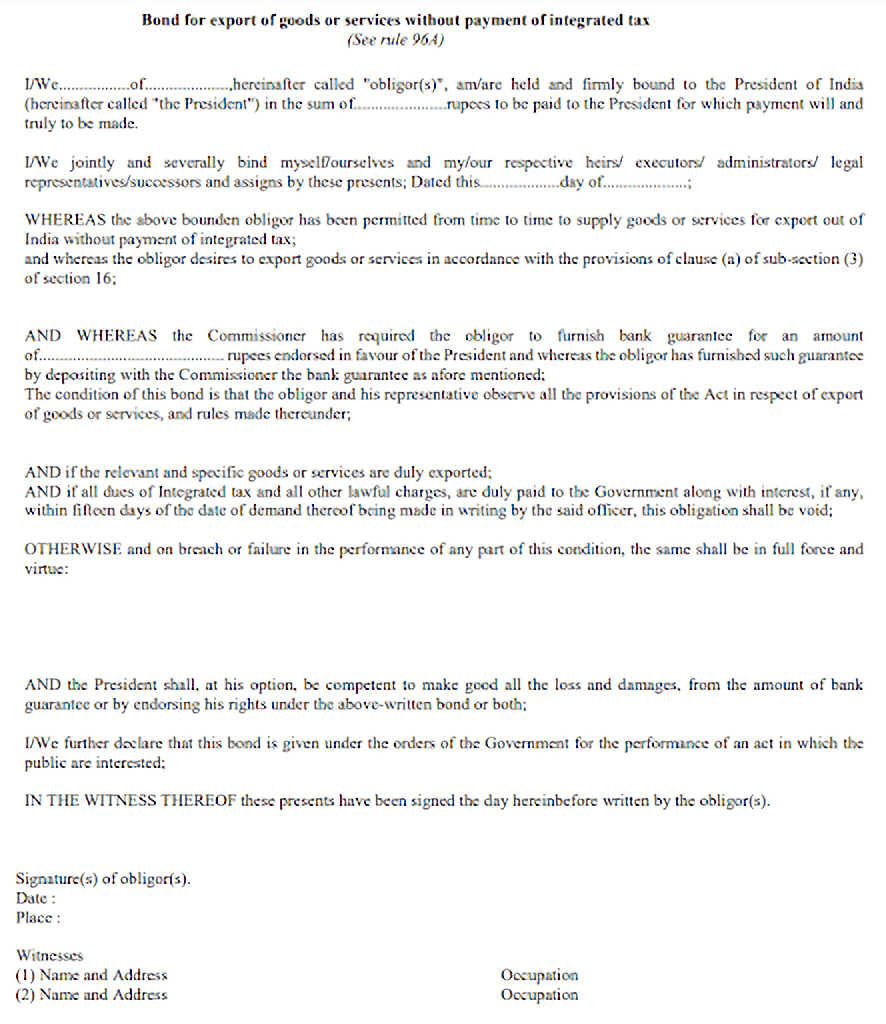

BOND FOR GST EXPORT

Those who don’t meet the requirements to submit a Letter of Undertaking will have to show an export bond and a bank security instead. Estimated tax debt self-assessment means that the person who wants to sell needs to pay the amount of tax that goes along with it.

Export bond should be given on non-judicial stamp paper with the amount that is required in the state where the bond is given.

Exporters can also provide a moving bond so that the export bond doesn’t have to be signed for every export deal. But if the unpaid tax on exports is more than the amount of the bond at any time, the seller must give a new bond to cover the extra tax.

An export bond can be paired with a bank guarantee. Most of the time, the value of the bank guarantee shouldn’t be more than 15% of the amount of the bond. But if the exporter has a good track record, the local GST Commissioner can waive the requirement that the exporter present a bank security along with the export bond.

ACCOUNT OPENING AT THE MOMENT

A current account is a specific kind of bank account that gives professionals and businesspeople an easier time managing their companies. By using an online current account, businesspeople are able to take advantage of a variety of perks, including the following:

- Transactions with no limits

- Adaptable characteristics

- Internet-based financial services

Having an online current account makes things easier and lets you do your banking whenever and wherever you want.

READY TO GROW YOUR BUSINESS?

- In about 5 minutes

- you can get a zero balance current account.

Free Current Account Powered by ICICI Bank

FAQS

The verification has to be signed and filed with DSC/EVC by either the primary authorised signature or any other authorised signatory. The person who is authorised to sign documents may be the working partner, the managing director, the proprietor, or another person who has been properly authorised to execute the form by either the operational partner or the Board of Directors of the firm or the owner.

Follow these steps at the GST Portal to see the submitted Letter of Undertaking (LUT):

1. Go to the GST Portal at www.gst.gov.in URL….

2. Sign in to the GST Portal with correct details.

3. Click the Services > User Services > View My Submitted LUTs button.

To view the submitted Letter of Undertaking (LUT) at the GST Portal, perform the following steps:

- 1. Access the GST Portal at www.gst.gov.in URL. …

- 2. Login to the GST Portal with valid credentials.

- 3. Click the Services > User Services > View My Submitted LUTs command.

The following papers are necessary for submitting a Letter of Undertaking (LUT) under GST.

- LUT cover letter – acceptance request – properly signed by an authorised individual

- Copy of GST registration

- PAN card of the entity

- KYC of the authorised person/signatory

- GST RFD11 form