Make Will Generator

Making a will is the process of creating a legal document that outlines how a person's assets and properties will be distributed after their death. It is a crucial step in estate planning, and it ensures that a person's wishes are followed after their passing.

Easy Process and Documentation

Required Paperwork

- Identification proof of the person making the will

- List of assets and properties that will be covered by the will

- Names and contact details of beneficiaries and heirs

- Name of the executor who will manage the distribution of assets

- Witnesses to the signing of the will (usually two witnesses are required)

Process, Service Charges, Time duration

- When you send us your paperwork, our experienced staff will review your paperwork with local government officials to determine the service’s cost, feasibility, and completion date. After a quote has been given, it remains fixed. Location affects project duration and cost. Send us your documents and specific requirements to get a price and turnaround estimate.

- On an average Procurement takes four to six weeks.

2000+ locations Served

Happy Clients 50000+

Averge Google Rating 4.9

India's Most Trusted Legal Documentation Portal

STEPS TO CREATE A WILL

Step 1

Go to our website, sign in, and click on the Will tab.

Step 2

Fill out all the fields with the necessary details.

Our team of lawyers will work on the sketch and send it to you. Once it’s done, you’ll be able to download it.

INTRODUCTION

A will is a legal declaration that a person makes regarding the distribution of his or her assets following the individual’s passing. It is a statement made by one person regarding his property that specifies, following that person’s death, how his property should be divided up among the surviving individuals. Wills are only valid once the decedent of the person making the will has passed away. Wills are not valid throughout the decedent’s lifetime. The individual who is creating it has the ability to revoke it and make changes to it at any moment. In India, anyone who is at least 21 years old can write a will for themselves.

MEANING

A person’s will is a legally binding declaration they make about what will happen to their possessions after they pass away. It is done by one individual with regard to his property, describing how his property should be divided among others after his death. A will only becomes effective once the maker of the will passes away. The person who is making it has the right to cancel and change it at any moment. Anyone in India who is older than 21 can create a will.

NEED FOR MAKING A WILL

The lack of a valid will creates the potential for a contentious legal battle in the future over the distribution of the deceased person’s property. Consequently, drawing out a will is something that should almost always be done. When a person writes a will, it is not said to be made in accordance with the Succession Act; rather, it is said to be made in accordance with the person’s own choice, and the person writing the will has the ability to select who should receive whose property. Therefore, the individual who is writing the Will is the only one who may decide which assets should be distributed to the surviving spouse, children, or parents. Only if the Will is created in accordance with these standards will all of these obligations be met.

In the event that a person passes away without a will, the succession act and the laws of his religion will be used to decide how his property will be distributed after his death.

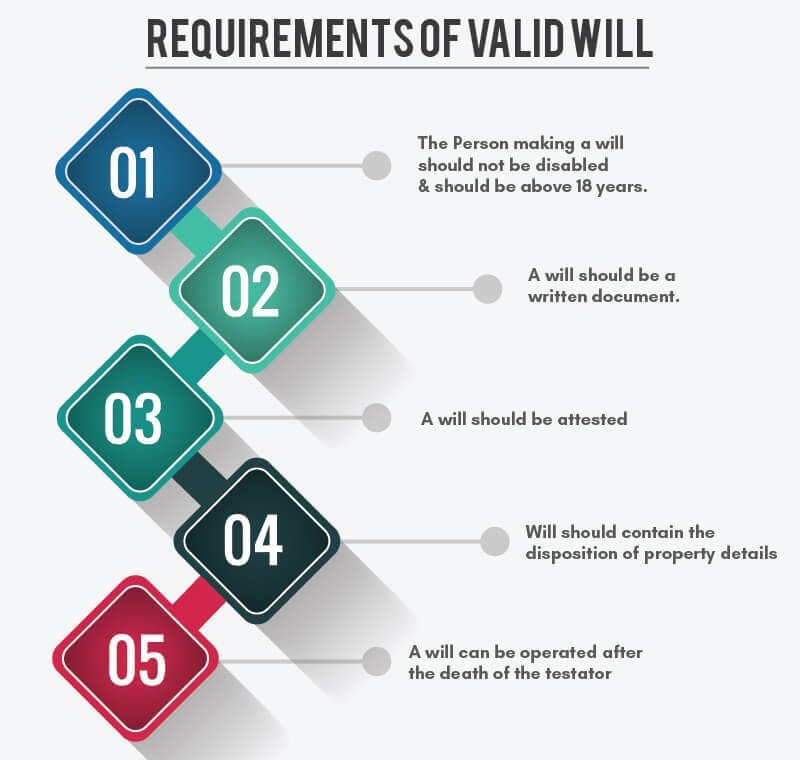

REQUIREMENTS FOR A VALID WILL

Under Indian law, there are some basic requirements for making a Will that is legal:

1. Major:

A person making a will should be at least 18 years old and mentally stable enough to understand on his own.

2. Written:

A Will should be put down because a written document is more reliable than a verbal one.

3. The proof:

A Will should be signed by the person making it and by two people who saw them make it.

4. Declaration of Law:

A Will is a legal document that says how a person wants his or her property to be split between his or her legal heirs or cousins.

5. What to do with the property:

The Will should possibly explain how the property will be given away.

6. The testator’s death:

Wills don’t work while the person who made them is still alive. They take effect after the person who made them dies.

WHO CAN CREATE A WILL?

Under Indian law, there is a minimum criterion that must be satisfied in order for a will to be considered valid. These requirements are as follows:

1. A will can be written by anyone of legal age and mental capacity who is able to do so.

2. A person who is the sole owner of the property that was gained via self-employment is eligible to write a will for the property.

3. A person who is typically mad but who occasionally demonstrates sanity is able to write a will for himself.

It is impossible for a person to write a will when they are under the influence of alcohol or drugs, experiencing mental illness, or in any other state in which they do not possess a sound mind.

TYPES OF WILL

Generally, there are two types of Will:

i. privileged Will:

In plain and simple terms, the privilege Wills are drafted with the intention of bestowing certain privileges on particular individuals, such as service members of the armed forces, marines, sailors, and soldiers, while these individuals are doing their duties. This will is drawn up so that the property can be disposed of while they are serving their duty. If it is made verbally, then it is good for one month, but if it is made in writing, then it is valid throughout the entirety of the time period.

ii. Unprivileged Will:

According to Section 63 of the Indian Succession Act 1925, a person is considered to have created an unprivileged will if they are not included in the group of people who are considered to have a privileged will. This kind of will can be nullified either by writing a new will or by the testator making a statement with the intention of nullifying the previous one.

THE REGISTRATION OF WILLS

Registration is not required, but it gives the paper legal standing. There is a normal way to get a Will registered, which is as follows:

A. In order to proceed, you will need to create an account on our website and fill out the necessary forms, all of which are now empty. While doing so, you should keep in mind that the information you provide should be correct. In addition to the draught of the will, one must also produce photocopies of the following: evidence of address, proof of identification, and specifics of the property.

B. Once the Will has been written, it needs to be printed out on standard paper. Moreover, the same should be attested by two witnesses who shall affix their identifying documents and address evidence.

C. After the attestation has been completed, the document in question is brought before the registrar. After the registrar has examined the document in question, he or she will determine the date and time of the registration, after which the registration will take place. The certified copy is handed over to the testator at the same moment the registrar completes the process. In the event that you require any assistance with the registration process, then our team of highly qualified solicitors is always available to assist you.

PERFORMANCE OF A WILL

After the testator dies, the executor of the Will or the heirs of the dead can go to the District Court or High Court, depending on where they live, and ask for probate. The court asks the executor or the legal heirs if they have any problems with the Probate. If there are no problems, the court gives the Probate. If there were any complaints, their citations were served in the same way. And after that, Will starts to work.

STAMP DUTY PAYMENT

There is nothing of exceptional value that is offered. The amount that must be paid for stamp duty varies from one state to the next, but in general, stamp duty is computed by taking into consideration the following factors:

- The property’s age and whether or not it is new.

- The property’s location.

- How the property can be used.

- Connection to Testator.

- What kind of land.

- The property’s value.

VALIDITY OF OF WILL

Wills are not put into effect until after the testator has passed away. When the testator is still living, it is impossible for it to take effect. It will cease to function properly if it goes into operation while the testator is still alive. The passing away of the testator is one of the most important preconditions for a will.

WILL REVOCATION

A Will can only be changed or revoked by the Testator as long as he is able to get rid of the Will. There are three ways to get a passport revoked:

1) Ruin the old Will:

The quickest way to cancel the Will is to destroy it. For example, it can be burned, torn, or shredded. So that it won’t be renewed.

2) Making a new will:

If someone makes a new Will, the old Will is immediately invalidated.

3) Modify a new Will:

A testator can change an existing Will, which can be viewed as a revocation. A cancelled Will is called a Codicil.

PROBATE

In simple terms, probate is a copy of the Will that has been signed and sealed by a court with the right to do so, along with permission to manage the estate of the person who died. The main reason to get the inheritance is to prove that the Will is real.

ADVANTAGES

A will has the following advantages which are listed below:

1. Right Allocation:

The major benefit of making a Will is that it makes it easy to divide the property among the legal heirs of the deceased. Otherwise, if the person who died didn’t leave a will, the property would be divided according to the rules of succession, not according to what the person would have wanted. dead about

2. Avoids Future Problems:

The main reason to make a will is to avoid misunderstanding over property in the future. If a person dies without a will, it causes problems between the relatives of the deceased over the property, which can lead to a property conflict.

3. Protects your wealth from being contested:

If a Will is written carefully, there is less chance that the property will be challenged.

4. Provide more room for inheritance:

The main purpose of a Will is to give preference to inheritance over other ties. When you hear the word “inheritance,” it means that the person’s property will go to his or her legal heirs, such as a son, daughter, partner, or parents. After that, other relatives come into the picture. Names of other people, other than legal heirs, can only be added in rare situations.

LAWS CONCERNING WILLS

There are many laws that pertain to wills, some of which are given as follows :

1925 Indian Succession Act

Hindu Personal Law (Hindu Law)

Muslim Law (the personal law of Muslims)

1908: The Indian Registration Act

MAKE WILL GENERATOR FAQS

Different types of documents are subject to varying rates of stamp duty. As a result of this, there is no specific format or computation that is available in the tabular form that yields an exact amount of stamp duty. When it comes to wills, the amount of stamp duty that must be paid might vary depending on a number of circumstances, including the testator’s property, the testator’s relationship with the testator, the property’s location, and so on.

Most people do get the gift deed and will confused. Because of all the misunderstanding, they decide that both are the same.But let me tell you one thing: both ideas are too different in fact. Everything about the two is different, from how they work to how they’re written.A Will is a written statement of how the author wants his property to be divided after his death. Whereas, a Gift Deed is a legal document that is made out of love and respect when someone wants to give their property to someone else. There is no factor to take into account in either case. A Will goes into effect after the person dies. On the other hand, in a gift deed, anyone can give away property at any time.