Pan Card Online

Application via NSDL Portal

The PAN, or Permanent Account Number, is used to uniquely identify individuals who are eligible to pay taxes in India. Indian citizens who pay taxes are issued a Pan Card, which is a 10-digit alphanumeric (letters and numbers) identification number.

Easy Process and Documentation

Required Documents

- Documents related to proof of identity

- Documents related to the proof of address

- Documents related to the proof of birth

Cost and Timeframe

- When you send us your paperwork, our experienced staff will review your paperwork with local government officials to determine the service’s cost, feasibility, and completion date. After a quote has been given, it remains fixed. Location affects project duration and cost. Send us your documents and specific requirements to get a price and turnaround estimate.

- On an average Procurement takes four to six weeks.

2000+ locations Served

Happy Clients 50000+

Averge Google Rating 4.9

India's Most Trusted Legal Documentation Portal

Pan Card Online– How to get Pan Card Online

A Comprehensive Guide to Indian PAN Cards

Tax Justice Network report reveals India lost 57.4% of its overall income tax revenue to MNC tax fraud by 2020. 42.6% of income tax was lost owing to private tax avoidance, totaling over 300 billion rupees (1).

If that isn’t enough to convince an individual to look up “how to apply for a PAN card” on Google, the fact that this document’s application in other areas has significantly risen over the past several years should do the trick. Because of this change, it is now extremely difficult to function without a PAN card.

You still haven’t gotten yours, have you?

Take a look at what it is as well as the application process for getting one.

What exactly is a PAN Card?

As you may not know, PAN stands for Permanent Account Number, a 10-digit alphanumeric code used for unique identification. The Income Tax Department is responsible for making this number available to potential taxpayers in order to curb tax evasion.

This is possible because PAN is an electronic system that tracks all taxpayer financial transactions. No two people can have the same number here. This unique identification number is assigned to each individual via a laminated card called a PAN card. You may be wondering,

Now, you might be wondering, “What is a PAN card used for?”

Well, a lot of things. Read on to know more!

What are the advantages of having a PAN Card?

Along with Aadhaar and Voter ID, the PAN card is an important identifying document. It’s also required for completing the following processes, among others.

- During IT return filing, a PAN card is highly crucial.

- Financial institutions charge 20% extra TDS on Rs.10000+ generated interest without PAN.

- Linking your bank account to PAN might help you claim a TDS refund.

- PAN card is necessary to open a bank account.

- Buying and selling immovable properties over Rs.10 lakh.

- PAN cards are required for transactions over Rs.50000.

- If you want to invest in mutual funds, bonds, or stocks, get a PAN card as soon as possible.

- This ID is needed for daily cash deposits exceeding Rs.50000.

- If you pay more than Rs.50000 in life insurance premiums in a fiscal year, you have to pay a tax.

That’s a list of situations where a PAN card benefits a taxpayer. There’s more.

Increased PAN card ownership benefits the IRS in the following ways.

PAN cards record a person’s financial activities and tax liabilities, addressing system gaps.

It helps authorities establish each person’s tax rate depending on income.

It helps calculate tax revenue more accurately.

Individuals without a PAN card can disclose this on Form No.60. Immediately apply for a PAN card. First, determine your eligibility.

What are the PAN Card eligibility requirements?

Here’s a list of entities eligible for a PAN card under Section 139A of the Income Tax Act.

Every person has taxable income over the limit.

A company owner with Rs.5 lakh+ in annual sales.

Karta or family head of every Hindu Undivided Family (HUF).

Any corporation, LLP, AOP/BOI, etc.

Charity, trust, or organisation.

Any prospective taxpayer minor must apply for a PAN card. This shows there’s no application barrier. This document is needed by most Indians and NRIs.

With so many varieties of PAN card holders, authorities have created segregations.

What kinds of PAN Cards are available?

PAN cards are categorised by taxpaying organisation. This category is indicated by the 4th character of each PAN, which differs. Here are various alphabets and their meanings.

A: Association of Persons (AOP)

B: Body of Individuals (BOI)

C: Company

E: Limited Liability Partnership (LLP)

F: Partnership Firm

G: Government Agency

H: Hindu Undivided Family (HUF)

J: Artificial Juridical Person

L: Local Authority

P: Individual

T: Trust

If you want to know how to apply for a PAN card, you should know that different entities on the list have different application forms. Read on to find out more about the application process.

How can I apply for a Permanent Account Number (PAN) Card?

Here’s how to apply online for a PAN card.

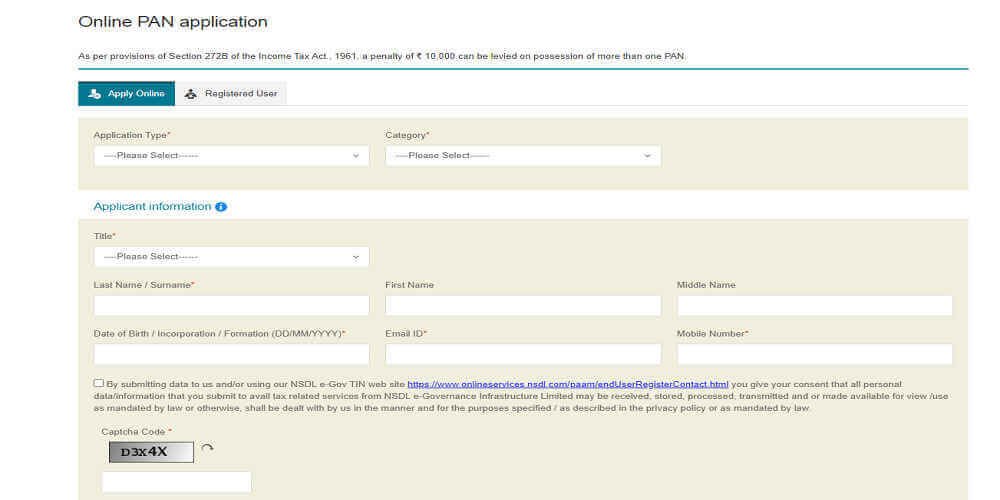

- First, visit UTIITSL or NSDL’s website.

- Second, click “Apply online.”

- Step 3: Select Form 49A or 49AA from “Application Type.” First is for Indian candidates, second for foreigners.

- Step 4: Choose your identification type from the list.

- Fill out the remaining blanks, input the security code, and click “Submit.”

- Step 6: Click “Continue with PAN Application Form”

- Step 7: You’ll be routed to your application form. Details needed.

- Step 8: Upload documents and click “Submit.”

- Pay PAN card costs, get the receipt, and click “Continue.”

- Step 10: After authenticating your Aadhaar number, you’ll receive an OTP.

- Step 11: Enter the OTP to finish.

After following the steps, you’ll receive a PDF acknowledgment slip. Date of birth in DD/MM/YY format may need a password.

Here’s how to apply for a PAN card without internet.

- Step 1: Get a PAN card application form from any district-level PAN agency.

- Step 2: Complete required fields. Attach 2 passport-size photos to the acknowledgment if you’re applying as an individual.

- Step 3: Attach all required documents and place them in an envelope labelled “APPLICATION FOR PAN-N-ACKNOWLEDGMENT NUMBER.”

- Step 4: Send the envelope to NSDL’s PAN Services Unit.

- Step 5: Send a demand draught to “NSDL-PAN.”

Now that you know the PAN card application method, you should have all the required paperwork on hand.

Required paperwork for obtaining a PAN card

The mandatory documents required when applying for this important document vary according to the type of taxpaying entity. To know about the required documents for your category, refer to the following table.

Taxpaying entity | Documents required |

Individual | ID proof, Address proof |

Companies | Registration Certificate issued by the Registrar of Companies |

AOP | Registration Certificate Number / Agreement copy provided by Charity Commissioner or Registrar of Co-operative Society |

LLP | Registration Certificate issued by the Registrar of Companies, Partnership deed |

Trusts | Registration Certificate Number issued by Charity Commissioner |

HUF | An affidavit stating details of all coparcener, issued by the Karta |

Foreign applicants | ID proof like OCI, PIO, copy of passport, etc., Address proof |

There is no turning back once you have all of the necessary paperwork and understand how to apply for a PAN card.

However, after successfully implemented, you would wish to watch the progress rather than waiting without notice, don’t you?

Let’s see what you can do!

How to check the current status of your application for a PAN Card.

There are numerous ways to check PAN card status. The easiest option is to use your 15-digit application acknowledgement number.

How to continue

- First, visit NSDL’s portal.

- Step 2: Tap “Track PAN Status.”

- Click “PAN-New/Change Request” under “Application Type.”

- Type your 15-digit acknowledgment number.

- Step 5: Enter the code and click “Submit”

- Next is your PAN application status.

You may be curious what a physical card looks like after you obtain it. Here are the specifics!

What information is available on a PAN card?

The following is a list of the information that may be found on the identification document of an individual.

- The cardholder’s given name

- Father name

- Birth date and time

- a number with 10 characters for the PAN

- Photograph of the cardholder and his or her signature

When it comes to a PAN card for commercial purposes, there won’t be any images or the name of the father on the card. Additionally, the cardholder’s name is changed to reflect the name of the company, and the date of birth is changed to reflect the day the company was registered.

Unfortunately, cardholders frequently discover inconsistencies in the information that is shown on their PAN cards. The good news is that the authorities provide procedures for adjustment of these facts, such as a PAN card address change and a PAN card name change as well. This is the good news.

How to correct PAN Card information

To update any incorrect information on your given PAN card, please refer to the section on applying for a PAN card online. Follow the instructions through Step 3, and then continue as detailed below.

- Select “Changes or Corrections to an Existing PAN Card” under “Application Type.”

- Fill out the PAN card rectification form with precise information on the next page.

- Upload all required papers and then click “Submit.”

- Complete needed payment.

- Now, you will receive a replacement receipt. Take a printout of the form and mail it to the Income Tax PAN Service Unit of NSDL.

Having a Social Security card with incorrect information is one thing; misplacing it is another. Moreover, guess what? You now also have a solution to this problem.

How to apply for a duplicate version if a PAN card is lost?

Stop worrying about a stolen or misplaced PAN card. After Step 2 of how to apply for a PAN card online, apply for a duplicate.

“Application Type” drop-down menu: “Reprint of PAN card (No modifications to PAN data)”

Complete all required fields, upload documents, and submit.

Pay fees via payment gateways.

Duplicate PAN card issuance is comparable to fresh application.

Original or duplicate PAN card? Link it to your bank account.

Duplicate PAN cards can be obtained offline. Simply pick up a form at PAN, TIN, or IT PAN Service Centers. Complete this form, pay a fee, and apply.

How to Link PAN Card number with your bank account

Your bank account information provides complete transparency into your financial transactions, and it is also where the IT department deducts taxes.

As a result, attaching your PAN card to your bank account is a method of connecting a PAN card to income tax. This may be accomplished in the following manner.

- Step 1: Log in to your internet banking account using your user ID and password on your bank’s web application.

- Step 2: You’ll see choices like PAN registration, Service requests, and Service. Choose the most appropriate option.

- Step 3: Next, choose whether to update or connect your PAN.

- Step 4: Enter your PAN number and any other relevant information.

After completing the aforementioned steps, you should anticipate your PAN and bank account to be successfully linked within 2-7 business days.

In addition to tying a PAN to a bank account, Section 139AA of the IT Act, implemented in the Union Budget 2017, requires every taxpayer to link a PAN card to an Aadhaar card.

So, if you haven’t already done so, hurry before the deadline!

If you have any more questions about this document, you can call the PAN card customer service number listed on the NSDL webpage.