DEED OF RECTIFICATION

A Deed of Rectification is a legal document used to correct errors or omissions in a previously executed agreement or deed.

Easy Process and Documentation

Required Paperwork

- Original deed or agreement that requires rectification

- Details of the errors or omissions in the original document

- Corrected clauses or provisions that need to be inserted

- Signature of all parties involved in the original agreement or deed

- Witnesses to the signatures

Process, Service Charges, Time duration

- When you send us your paperwork, our experienced staff will review your paperwork with local government officials to determine the service’s cost, feasibility, and completion date. After a quote has been given, it remains fixed. Location affects project duration and cost. Send us your documents and specific requirements to get a price and turnaround estimate.

- On an average Procurement takes four to six weeks.

2000+ locations Served

Happy Clients 50000+

Averge Google Rating 4.9

India's Most Trusted Legal Documentation Portal

A rectification deed is a legal document that lets you get rid of any mistakes or errors in any other legal document. A rectification deed is often used to fix mistakes in conveyance deeds that are part of a real estate transaction. If you find mistakes in your sale deed or any other document related to your property, you should have a rectification deed (also called a “deed of rectification”) written and registered to cancel out the mistake.

What is a rectification deed?

A rectification deed is an essential piece of legal documentation that provides purchasers and vendors with the opportunity to rectify errors that have been made in official papers such as title deeds and sale deeds. There are a variety of names for a rectification document, including a deed of confirmation, correction deed, confirmation deed, supplemental deed, amendment deed, and so on.

The Indian Registration Act, 1908 recognises the rectification deed as a totally valid means of correcting mistakes in legal documents. This provision may be found in Section 17 of the act. In order for the deed to have any legal weight, it needs to be registered.

When is a rectification deed often utilised?

A rectification deed can be used to correct a variety of issues, including spelling errors, typing errors, property description inaccuracies, and so on. A supplemental deed can also be established to make changes to the original deed.

Please keep in mind that the amendment deed can only be used to repair factual inaccuracies in property records. If there are legal errors and/or if you want to modify the essential essence of the original deed, your application to register a rectification deed will be refused. Also, in the rectification document, one must guarantee that neither party’s interest changes.

More crucially, the sub-registrar will only approve your application for rectification deed registration if he is persuaded that the error in the original document was unintentional. All contract parties must agree on the proposed revisions and attend in the sub-registrar’s office for the deed’s registration.

Mistakes that can be fixed through a rectification deed

- Mistakes in spelling

- Typing errors

- Repetitions

- Numeric errors

- Complex sentence construction

Conditions for writing a rectification deed

You can only start the process to get a correction deed if you meet the following conditions:

- The mistake in the first document is real.

- The mistake in the original deed was not done on purpose.

- All of the people who signed the original deed agree to make a correction deed.

Not in the scope of correction act

A correction deed cannot fix the following mistakes in a sale deed:

- The basic nature of the deal.

- Payment of insufficient stamp tax.

- Jurisdictional mistakes with the sub-registrar’s office.

Charges for rectification deeds

At the office of the sub-registrar, registering a correction deed requires a payment of Rs 100, which is considered to be a nominal price. Having said that, this is only valid in the event that the original papers include only a few typographical or spelling-related alterations. If there are significant alterations that need to be made to the document, the office may demand a greater stamp duty since they will consider the transaction to be a new one.

Is there a time limit for executing a rectification deed?

There is nothing in the statute that specifies a time limit within which an error or mistake must be rectified in any document, even if it was created intentionally. When one of the parties participating in the transaction discovers that the property document has erroneous information or typographical mistakes, they are responsible for alerting the other party involved in the transaction as soon as possible so that they can create a rectification deed to rectify the issue and complete the transaction.

In point of fact, the Bombay High Court in March 2023 permitted a correction to be made in a sale deed after 38 years had passed after its execution. The court reasoned that Section 5 of the Limitations Act is elastic enough to apply in the law in a meaningful manner to fulfil the goals of justice.

Having said that, given that these documents serve as the legal confirmation of your ownership over an item, getting any inaccuracies remedied as quickly as possible is essential. Your status as the owner of the business might be in jeopardy if you do not correct the inaccuracies.

The procedure for creating a rectificationn deed

If any party discovers a mistake in the sale deed, both the buyer and seller must attend before the sub-registrar’s office where the transaction was previously recorded. They must file an application to the official, together with any supporting documentation, requesting that the document be corrected. If significant revisions are necessary in the original document, the two parties must additionally bring two witnesses each to the registration of the rectification deed.

Online rectification deed

You can also apply to have a correction deed executed online. To begin the process, you must go to the state land revenue department’s website.

Karnataka: https://kaverionline.karnataka.gov.in

Maharashtra: gras.mahakosh.gov.in/igr

Tamil Nadu: https://tnreginet.gov.in UP: https://igrsup.gov.in

West Bengal: https://wbregistration.gov.inBihar: http://bhumijankari.bihar.gov.in

Delhi: http://revenue.delhi.gov.in

Gujarat: https://services.india.gov.in

Contents of the rectification deed

Along with the specifics of the original deed, the personal information of the parties engaged in the transaction must be included in the copy of the deed that is being recorded. In addition to this, a clear description of the issue that needs to be fixed must be included. In addition to this, the parties will be required to provide an undertaking, in which they state that the original content and structure of the sale deed have not been altered in any way.

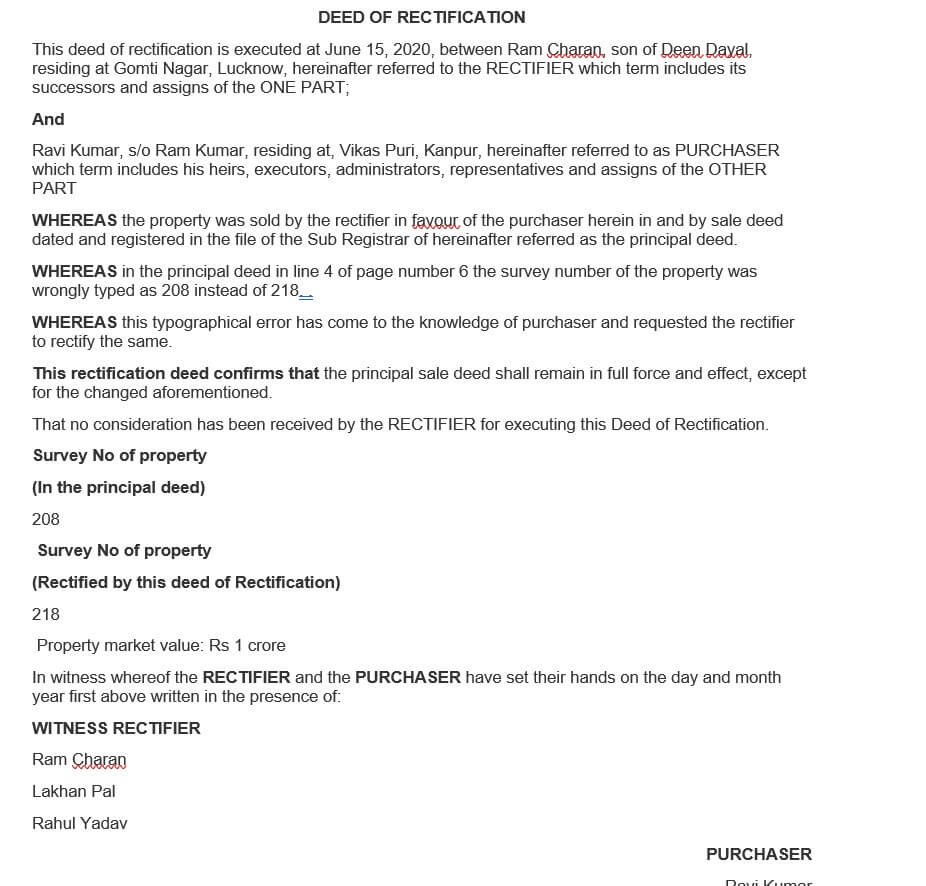

Format for a rectification deed

How do you handle rectification deed disputes?

In the event that one of the two parties is opposed to the recommended rectification, they are allowed to seek legal redress, and a lawsuit might be brought against the party that began the action to establish a rectification deed. When a contract does not convey the genuine purpose of the parties, either party may initiate a suit to have the document repaired in accordance with the provisions of Section 26 (a) of the Special Relief Act, 1963. This provision is found in the statute.

Key points to remember about rectification deed

Honest mistake: The mistake made in the original paper must be real and not be done on purpose. Also, the mistake must be true and not legal.

Registration: If the original deed was registered, the correction deed must also be registered.

Joint execution: All parties to the original agreement must take part in getting the correction deed registered.

Legal recourse against rectification: Parties who are against the performance of a rectification deed can seek relief under Section 26 of the Specific Relief Act, 1963.

FAQS

A rectification deed is a legal document that is completed between the original parties to an agreement in order to fix flaws that were made in the original agreement. Registering the correction deed is something else that has to be done.

A rectification document must be signed by all of the original participants in the transaction, and it must have their unanimous assent.

If the original papers only include a few typographical errors, the registration of a rectification deed will only cost a minimal fee of Rs 100. It is possible that the sub-registrar’s office will ask for a higher stamp duty if significant adjustments need to be made.